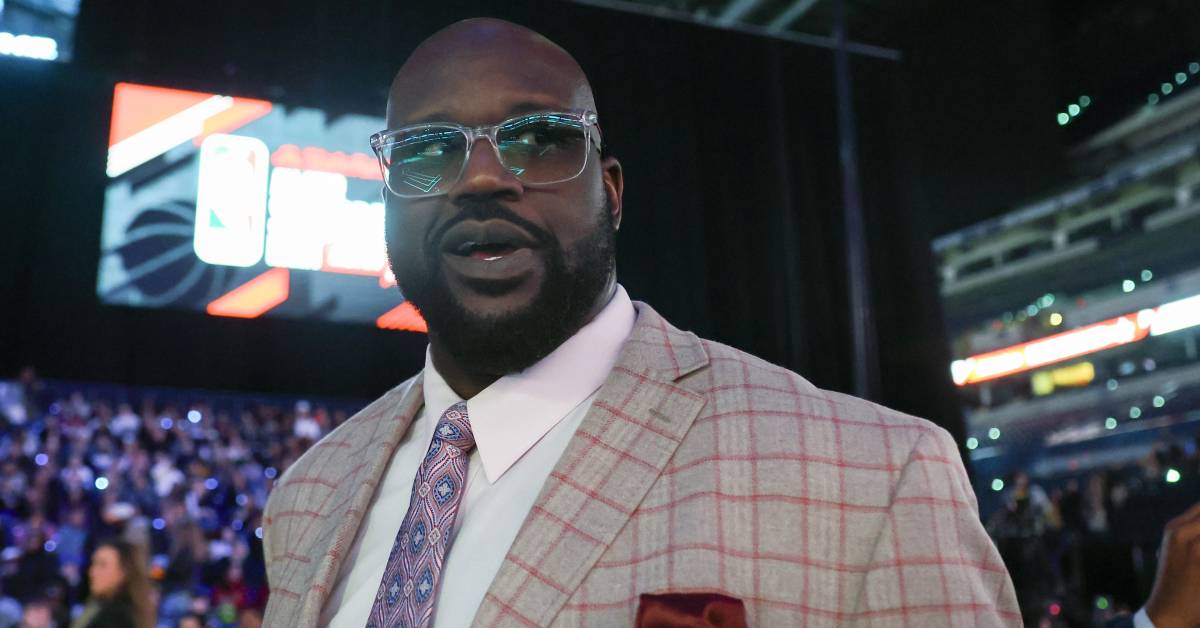

Alright, let me walk you through a weird one I handled way back. The task sounds simple, right? A credit check. But the name attached? That made it memorable. It was supposedly for Shaq’s mom’s house.

So, I was knee-deep in paperwork at my old job, processing applications day in and day out. Mortgages, mostly. You get numb to the names after a while. Then this file pops up. The name was Lucille O’Neal. Now, honestly, it didn’t immediately click. You see tons of names, you know?

Getting Started – The Usual Grind

First things first, like any other file, I had to make sure all the ducks were in a row. This meant:

- Checking the application form: Made sure everything was filled out. You’d be surprised how often people miss stuff.

- Getting the authorization: This is super important. You absolutely need explicit permission, usually a signed form, before you can pull anyone’s credit report. Privacy is key, and rules are rules. We kept copies of everything, digital and sometimes paper back then.

- Verifying identity stuff: Just cross-referencing details provided against what we had, making sure it wasn’t some obvious error or mix-up.

Standard procedure, really. Nothing too exciting yet. Just ticking boxes and making sure we were legally covered to proceed.

Running the Actual Check

Once I had the green light with all the signed forms and verified info, I logged into our system. We used the big credit bureaus – you know, Experian, Equifax, TransUnion. Usually had a primary one we hit first.

I carefully typed in the details – name, address history, social security number, the works. You gotta be precise here, one wrong digit and you pull the wrong report or get an error. Hit submit and waited a few seconds. The system usually spits it back pretty quick.

Then the report loaded. Okay, now the real look-see starts. I scanned the main things:

- The credit score: Obviously, that’s the big number everyone talks about. Gives you a quick snapshot.

- Payment history: Looked for any late payments, defaults, collections. This tells you how reliable someone is with paying bills back.

- Credit utilization: How much credit they’re using versus their total available credit. Lower is generally better.

- Length of credit history: How long they’ve been managing credit.

- Recent inquiries: Who else has been checking their credit lately.

I just read through it, making notes on the key points relevant to the application we were processing. Didn’t treat it any different than any other report, technically.

The “Oh, Right” Moment

It was only after I processed everything, compiled the summary, and passed the file along to the next step (underwriting, probably) that someone leaned over and said, “You know that’s Shaq’s mom, right?” And I was like, “Wait, the Shaq?” Suddenly the name clicked. Felt kinda funny afterwards, like I’d just peeked behind a curtain I wasn’t supposed to. But honestly, during the process, it was just another file, another checklist. You focus on the data, not the celebrity connection.

So yeah, that was it. Did the credit check, followed the steps, logged everything. Just a regular day doing the job, but with a story I could tell later. It really just boils down to getting permission, punching details into a system, and reading what comes back. No magic, just process.